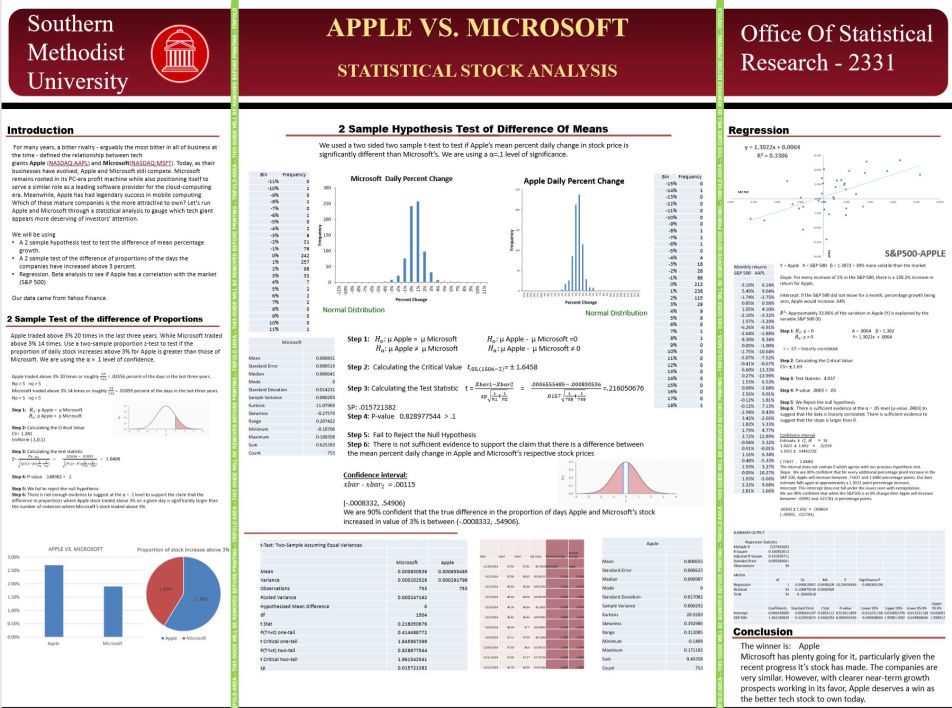

APPLE V. MICROSOFT VALUATION

The valuation of Apple's stock vs the valuation of Microsoft's stock. Which one should you buy? My project uses many different methods to measure risk, performance and expected future growth.

Testing

Hypothesis testing is one of statistics most powerful ways to determine the accuracy of a mathematical statement. It is important to know how confident you are in an answer. For this porject, I have achieved a 95% confidence interval

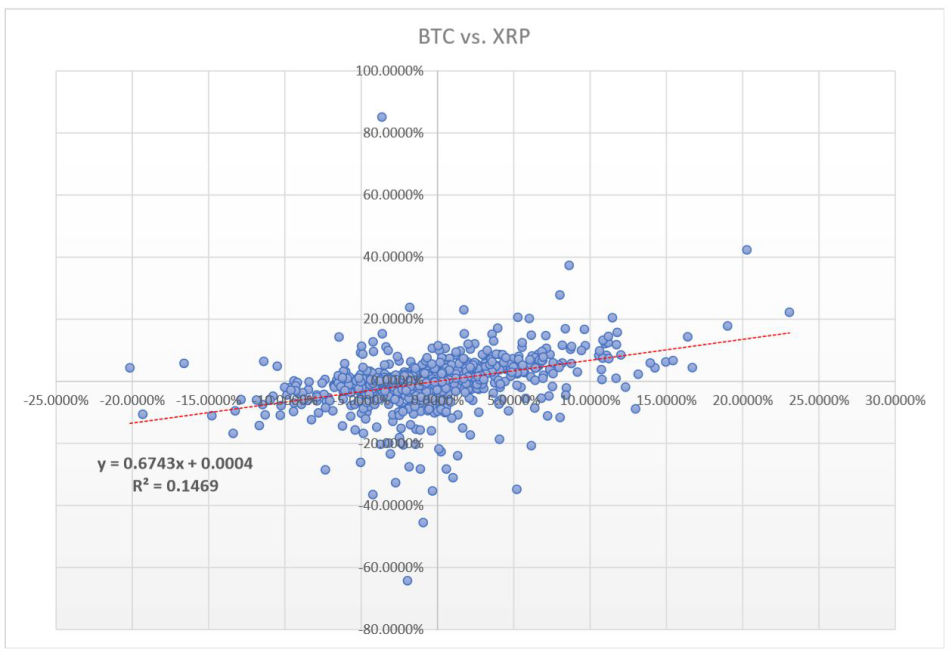

Linear Regression

In today's environment it is important to discover trends and patters. Linear Regression models helped me determine the relationship these firms have with the market industry. How correlated are these stock prices to market fluctuations?